What Happened in 2023 and a Glimpse into What’s Next in 2024

The financial technology (FinTech) sector has undergone a remarkable transformation in recent years, with artificial intelligence (AI) emerging as a driving force behind innovation. As we reflect on the developments of 2023 and peer into the future of 2024, it’s evident that AI is reshaping the financial services landscape. In this post, we’ll delve into the key areas where AI is making significant strides, explore real-world applications, address challenges, and anticipate the future trends that will continue to shape the industry. The publication “Artificial Intelligence meets FINTECH - everyone’s a winner” by Digitalk features an interview with Tsvetomir Doskov, CEO of Sirma Business Consulting, who answers questions on the topic.

Pioneering AI in Finance

One of the most compelling aspects of AI in the financial sector is its widespread implementation across various domains. Actively driving change in risk management, personalized financial services, customer service, regulatory compliance, and automation of intra-company operations, AI is becoming synonymous with financial innovation. Institutions are leveraging machine learning algorithms (MLA) and natural language processing (NLP) to enhance efficiency and accuracy in decision-making processes.

Risk Management with AI

Risk management lies at the heart of financial institutions, and AI is revolutionizing how these entities approach it. AI and machine learning algorithms are now indispensable tools for measuring credit, liquidity, market, and operational risks. Analysing vast datasets, AI identifies logical connections that may hide potential risks or losses. For example, predictive modelling using regression and correlation analysis aids in making measurements and studies in credit, liquidity, and operational risk management. This application of AI streamlines risk assessment and provides a forward-looking perspective by simulating and predicting the behaviour of consumers, borrowers, and business units.

Real-world AI Project at Sirma Business Consulting

Sirma Business Consulting stands out as a beacon of innovation in FinTech, actively engaged in a real-world AI project. The company employs machine learning, natural language processing, and computer vision for risk management purposes. The project involves the collection and calculation of financial data, specifically for determining the expected loss (EL) and its individual components, such as Probability of Default (PD), Loss Given Default (LGD), Exposure at Default (EAD), and Recovery Rate (RR). Using modelling and machine learning in this context allows for precise calculations that empower business and risk management experts in their decision-making processes.

The penetration of AI will be ubiquitous and strongest but will upgrade the software systems in the operational units of financial institutions. A few areas are currently “pioneers” in implementing AI. Still, I expect all major software vendors to start providing “ready-made” solutions in various business areas soon.

Tsvetomir Doskov, CEO of Sirma Business Consulting.

Challenges in Implementing AI

While the promise of AI in FinTech is substantial, challenges persist. One of the foremost hurdles is the scarcity of expertise. Implementing AI requires specialized training that is currently limited in scale. The traditional approach to programming is insufficient in the context of AI, demanding a shift in mindset and skillsets. Additionally, older software solutions without open and service-oriented architecture face integration difficulties with AI, underscoring the need for modernization in the industry. A critical challenge for businesses lies in structuring and cleaning the data required for machine learning, a prerequisite for effective AI utilization.

Automation Wave in Finance

The next 5-10 years are predicted to witness a sweeping automation wave powered by software robots, machine knowledge, and artificial intelligence. This wave is set to significantly upgrade software systems in the operational units of financial institutions. As AI becomes more prevalent, major software manufacturers are expected to offer “off-the-shelf” solutions in various business areas. The impact of operational efficiency within financial institutions cannot be overstated, as routine tasks are automated, allowing human resources to focus on more complex and strategic aspects of financial services.

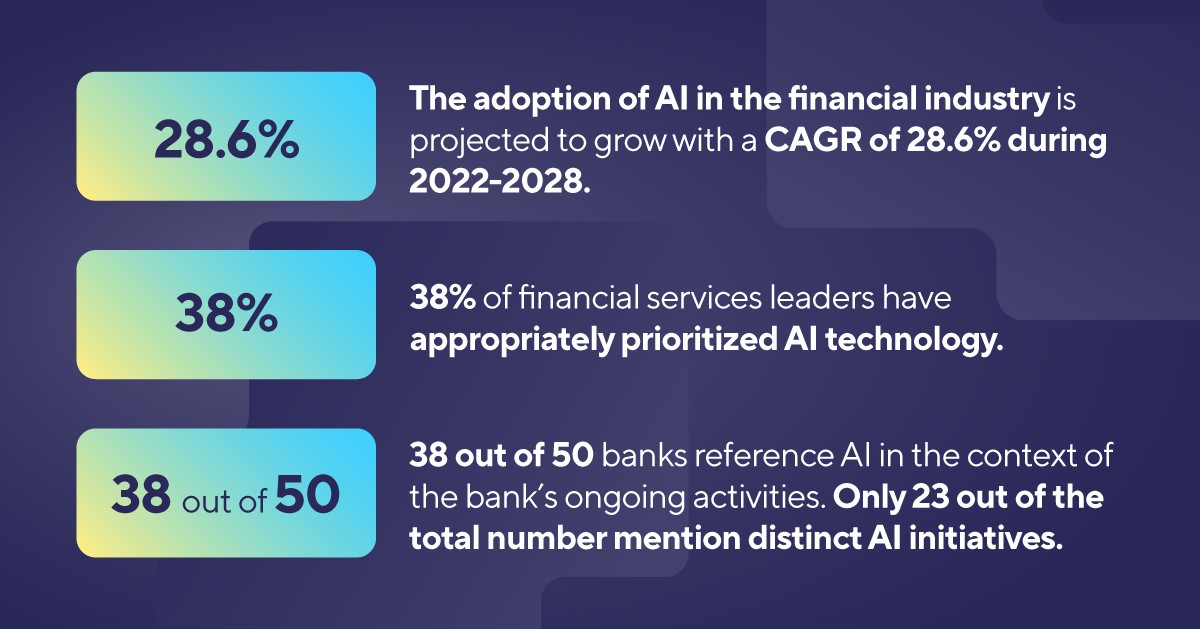

sources: figures are drawn from reports 1,2 and 3

sources: figures are drawn from reports 1,2 and 3

In conclusion, integrating AI into the FinTech landscape is not just a trend; it’s a transformative force shaping the industry’s trajectory. The pioneering efforts of companies like Sirma Business Consulting exemplify AI’s tangible benefits to risk management and financial operations. As we stand at the threshold of 2024, the industry must address the challenges of expertise and data structuring collaboratively to unlock the full potential of AI.

The impending automation wave promises to redefine operational norms, presenting challenges and opportunities for financial institutions to evolve with technological advancements. The journey of AI in FinTech is dynamic and promises a future where innovation and efficiency go hand in hand, revolutionizing how financial services are delivered and experienced.

Sources: 1. Digitalk’s report “Artificial Intelligence meets FINTECH - everyone’s a winner” (The report is available in Bulgarian only.) 2. Evident AI Index (Compare the AI capabilities of major banks with data from the Evident AI Index: the global standard benchmark of AI maturity for the banking sector) 3. KPMG report